Single Vs. Multiple Liquidity Providers – Which is Better?

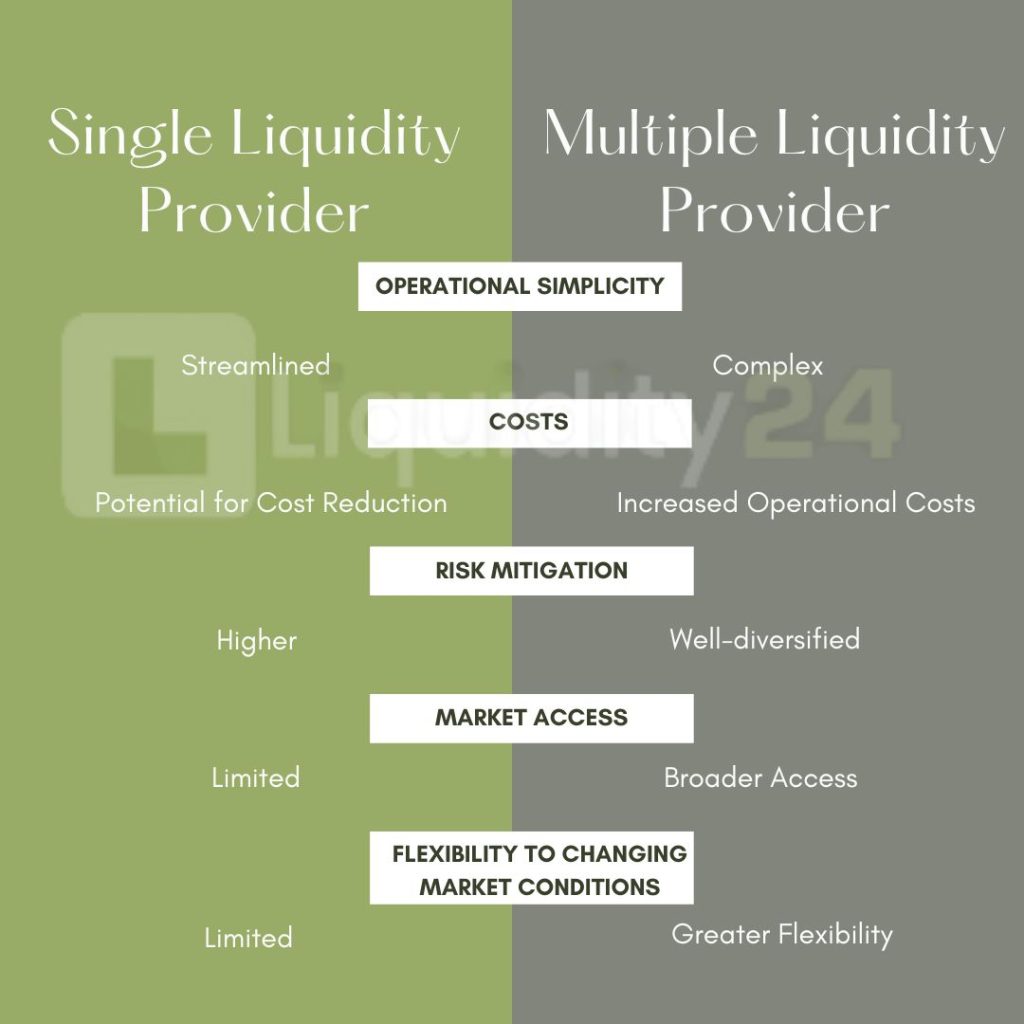

A liquidity provider is an institution that acts as an intermediary between traders or investors and the securities market. There is an age-old debate between single vs multiple liquidity providers among institutional investors, financial institutions, and trading firms.

Some market participants consider multiple liquidity providers as they provide diversification. On the other hand, some participants go for a single liquidity provider to reduce their costs.

In this article, let’s understand in detail about both aspects that help you choose one.

Single vs Multiple Liquidity Providers: What Does it Mean?

A single liquidity provider means relying totally on a single source to meet the liquidity needs of a financial operation. It helps simplify the processes of participants, as there is only one entity with which the trader or institution interacts to fulfill their liquidity requirements.

On the other hand, choosing more than one liquidity provider means diversifying sources of liquidity by engaging with more than one entity. By utilizing multiple providers, an organization can mitigate the impact of issues with a single provider and gain access to a wider range of markets or asset classes.

Increase your visibility as a liquidity provider by sharing your knowledge on our platform. Register today!

Which one to choose?

The choice between single and multiple liquidity providers is based on various factors, such as

Simplicity Vs. Complexity

If the entity is looking forward to having a simple structure through which liquidity can be accessed hassle-free, choosing a single liquidity provider could be a viable option. On the other hand, managing relationships with multiple providers can be more intricate. Each comes with its procedures, making coordination and oversight more demanding.

Diversification of Risk

Liquidity is the prime aspect of financial markets, without which no institution can survive. Depending on a single liquidity provider could be risky due to potential issues like technical glitches or contradictions. Having multiple liquidity providers is essential to diversify the risk of stopping the operations due to any small reason.

Broader Assets Class

If an entity is into different asset classes or looking forward to providing other asset classes to trade, you can go for multiple liquidity providers. There might be a case where your chosen liquidity provider still needs to enter the same asset class. It is always better to have a backup plan to avoid a mismatch at the last moment.

However, if the trading is concentrated and there are no near-term plans to broaden the area, it would be better to go for a single liquidity provider.

Conclusion

Ultimately, the choice between single vs multiple liquidity providers depends on the requirements and future objectives. It mainly revolves around a well-thought-out balance of simplicity versus complexity and concentration versus diversification. It’s essential to decide between the stability of a single investment and the potential resilience offered by a diversified portfolio.

To choose between single vs multiple liquidity providers, analyze the requirements and current and future business operations, which could be a crucial factor in making well-driven decisions.

Sign Up for free to stay tuned for further updates.