How oneZero Empowers Modern Trading in Multi-asset Space?

Technology partners are crucial for success in financial markets. oneZero is a leading provider of cutting-edge software solutions tailored specifically for financial institutions engaged in Forex and multi-asset trading.

What is oneZero?

oneZero is a top trading technology provider that offers advanced software solutions for forex and multi-asset trading to retail brokers, financial institutions, and liquidity providers.

oneZero offers advanced technology and comprehensive services to help institutions navigate financial markets with confidence and efficiency.

The company has a global presence, with development and operations centres strategically located across Asia, Australia, Europe, North America, and the United Kingdom. This expansive footprint allows oneZero to provide superior service and support to its 200+ customers worldwide.

Find your perfect liquidity partners now and join a global network of finance professionals!

What Does oneZero Offer?

Founded in 2009 by technology visionaries Andrew Ralich and Jesse Johnson, oneZero emerged in the heart of innovation in Cambridge, MA. With a robust technological infrastructure, oneZero’s platform handles over $100 billion in average daily volume (ADV), processes more than 6 million transactions daily, and manages billions of quotes daily. This staggering capability underscores oneZero’s commitment to delivering unmatched performance and reliability to its clientele.

oneZero offers a comprehensive suite of services designed to address the diverse needs of financial institutions:

Hub Technology

oneZero’s Hub Technology represents the pinnacle of Software-as-a-Service (SaaS) price and risk management systems. Trusted by clients worldwide, Hubs empower users to manage and route tens of millions of trades daily effortlessly.

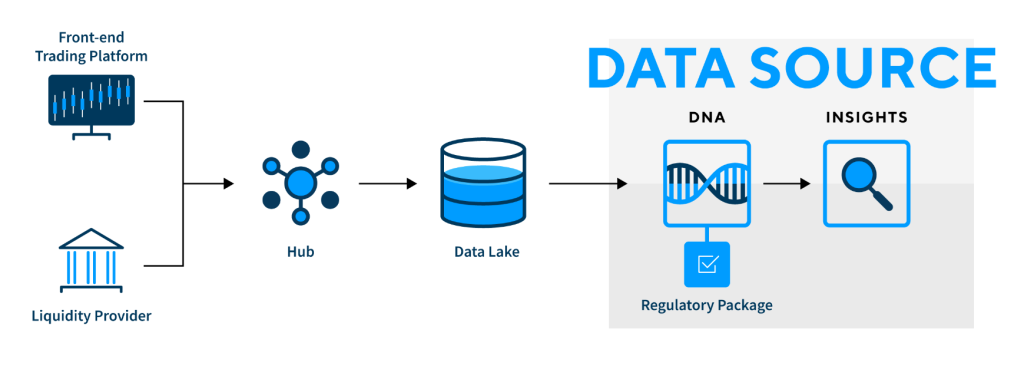

Data Sources

oneZero offers advanced Data Analytics solutions that provide valuable insights into trading performance and market trends. With data analytics, institutions can enhance their trading strategies, identify opportunities, and make informed decisions for growth and profit.

EcoSystem

EcoSystem is a nexus where brokers, banks, and liquidity providers converge for unparalleled liquidity distribution and access to unique flow dynamics. It provides direct market access, enabling seamless connectivity and collaboration among traders, resulting in a dynamic trading environment.

What Benefits Do You Get?

Here are some of the benefits that oneZero offers.

Enhanced Liquidity

Institutions can access competitive pricing, ample liquidity, and enhanced execution quality through oneZero’s Hub Technology.

Improved Execution Speeds

oneZero’s technology enables institutions to execute trades with minimal delay, reducing slippage and maximising trading efficiency.

Reduced Risk Exposure

oneZero’s risk management tools help institutions monitor and manage their market risk exposure, ensuring compliance with regulations and internal policies.

Increased Transparency

oneZero provides trading technology solutions for institutions to optimize their trading strategies by offering transparency into trading activity, liquidity usage, and execution performance.

Scalability and Flexibility

oneZero’s solutions are scalable, flexible, and customizable to adapt to changing market conditions and institutional growth.

How oneZero Empowers Modern Trading?

oneZero simplifies trading operations for financial institutions by:

- Streamlining Connectivity: oneZero simplifies connectivity to multiple liquidity providers, reducing complexity in managing trading relationships.

- Automating Processes: oneZero automates trading processes like order routing, risk management, and reporting, freeing up resources for business growth.

- Offering Customizable Solutions: oneZero provides tailored technology solutions for institutions to align with their specific trading needs and business objectives.

Wrapping Up

oneZero is a leading multi-asset class trading technology provider for financial institutions engaged in Forex and multi-asset trading. oneZero provides institutions with advanced technology and services to improve trading operations by offering enhanced liquidity, faster execution speeds, risk mitigation, and greater transparency and efficiency.

To know more about how to amp up trading, follow us on LinkedIn.