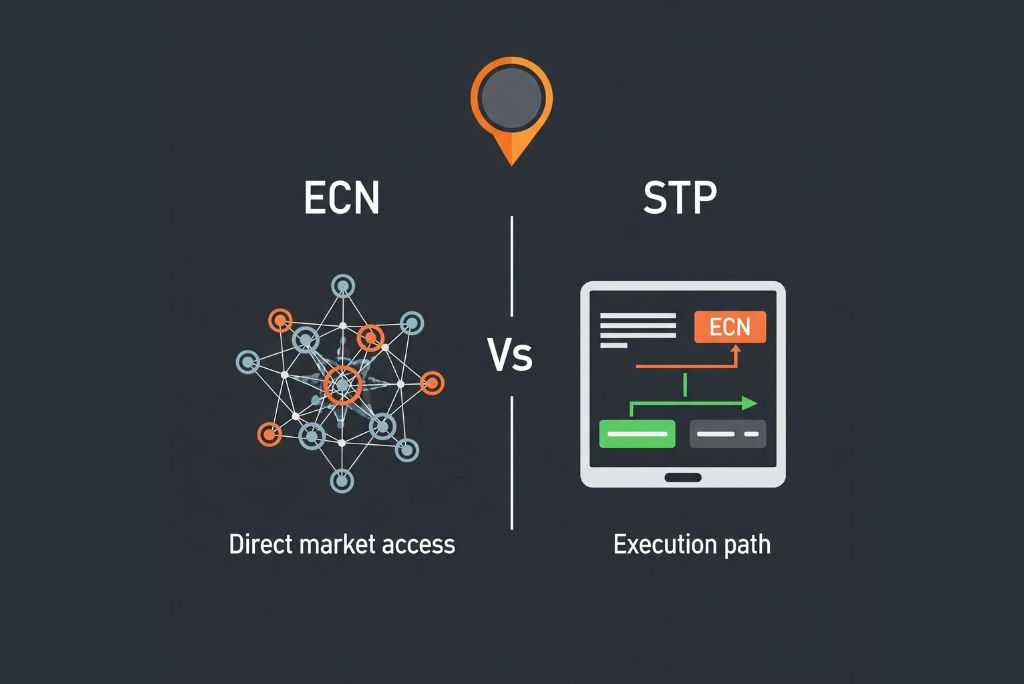

ECN vs STP: How to Choose the Ideal Broker for Your Trading in Financial Markets

In the dynamic world of trading, choosing the right broker is one of the most important decisions an investor can make, whether they are a beginner or already have market experience. With the proliferation of offers and the sophistication of platforms, it is common to come across terms like “ECN” and “STP” in broker advertisements. But what do these acronyms really mean, and how do they impact the trading experience? Understanding the difference between both models is essential to optimize results and avoid unpleasant surprises.

What is an STP Broker?

STP stands for “Straight Through Processing.” This broker model uses advanced internal technological systems that allow client orders to be sent directly to liquidity providers (LPs) without manual intervention. STP brokers act as a bridge between the trader and the market, using algorithms that function as oracles to select the best price and the greatest market depth available at any given time.

One of the main advantages of the STP model is that it allows trading with larger capital and executing bigger orders without suffering significant slippage, as the system automatically seeks the best counterparty among several providers. Additionally, spreads are usually variable and, in some cases, more competitive than those of traditional brokers. The STP model is ideal for traders seeking efficiency, transparency, and fast execution, but who do not necessarily require direct access to the market order books.

What is an ECN Broker?

ECN stands for “Electronic Communication Network.” This type of broker connects traders directly with a network of market participants, including banks, investment funds, other brokers, and individual traders. ECN technology eliminates technological intermediaries and allows orders to be matched directly between participants, resulting in greater transparency and, in many cases, better execution prices.

A distinctive feature of ECN brokers is the possibility of trading through direct connections such as FIX API, which is especially attractive for algorithmic traders and scalpers who require minimal latency and ultra-fast execution. However, it is important to note that, in most cases, ECN brokers impose certain volume restrictions, being more efficient for trades of up to 2 lots per asset. For larger volumes, there may be liquidity limitations or increased transaction costs.

Key Differences Between STP and ECN

Although both models aim to offer efficient and transparent execution, there are technical and operational differences that can influence a trader’s choice:

Order execution: STP brokers send orders to a selection of liquidity providers, while ECN brokers match them directly between network participants.

Spreads and commissions: ECN brokers usually offer tighter spreads but charge a fixed commission per trade. STP brokers, on the other hand, may have variable spreads and sometimes do not charge additional commissions.

Market depth: ECN brokers allow you to view the real market depth (Level II), showing available buy and sell orders, which is useful for advanced strategies.

Latency and speed: Thanks to their infrastructure, ECN brokers offer lower latency and higher execution speed, which is crucial for algorithmic trading and scalping.

Accessibility: STP brokers are usually more accessible for retail and beginner traders, while ECN brokers are geared towards professional or institutional traders.

The choice between an ECN or STP broker largely depends on the trading strategy, the investor’s profile, and their knowledge of how the markets work.

For beginner traders, who are not usually too concerned about spreads or slippage and are looking for a simple and straightforward experience, an STP broker may be more than sufficient. This model offers efficient execution and competitive prices without the need to deal with advanced technical configurations.

On the other hand, experienced traders, especially those using algorithms, high-frequency strategies, or scalping, will find ECN brokers provide the ideal infrastructure for their needs. The possibility of connecting via FIX API and the transparency in price formation are key advantages for those looking to optimize every millisecond of execution.

Additional Considerations When Choosing a Broker

Beyond the execution model, it is essential to evaluate other aspects before making a decision:

Regulation and reputation: Make sure the broker is regulated by recognized authorities and has good references in the community.

Platforms and tools: Check that it offers modern platforms compatible with your technological needs (MetaTrader, cTrader, APIs, etc.).

Support and customer service: Good support service can make a difference in critical moments.

Total costs: Consider not only spreads and commissions but also possible hidden fees, swaps, and withdrawal conditions.

By Stephany Rojas Duque

Specialist in brokerage and fintech new technology direction